Supreme Court judgement- only 10 % of the estimated evasion of GST is to be deposited for no coercive action

In a landmark decision of suit filed by JC Group, COIMBOTORE,( lead and Batteries manufacturing company) against the harassment of GST Department, only 10 % of the estimated evasion of GST is to be deposited for no coercive action.

In a landmark decision of suit filed by JC Group , COIMBOTORE against the harassment of GST Department. JC Group is a lead and Batteries manufacturing company in coimbatore, Tamilnadu. Supreme Court ordered the GST Department to deposite only 10 % of the estimated evasion of GST for no coercive action.

See the Complete Judgment_

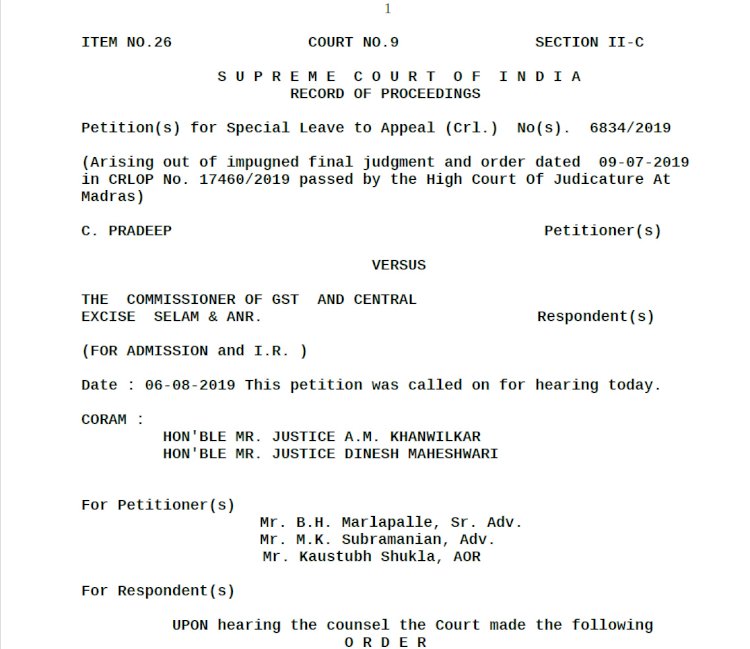

1

ITEM NO.26 COURT NO.9 SECTION II-C

S U P R E M E C O U R T O F I N D I A

RECORD OF PROCEEDINGS

Petition(s) for Special Leave to Appeal (Crl.) No(s). 6834/2019

(Arising out of impugned final judgment and order dated 09-07-2019 in CRLOP No. 7460/2019 passed by the High Court Of Judicature At Madras)

C. PRADEEP Petitioner(s)

VERSUS

THE COMMISSIONER OF GST AND CENTRAL

EXCISE SELAM & ANR. Respondent(s)

(FOR ADMISSION and I.R. )

Date : 06-08-2019 This petition was called on for hearing today.

CORAM :

HON'BLE MR. JUSTICE A.M. KHANWILKAR

HON'BLE MR. JUSTICE DINESH MAHESHWARI

For Petitioner(s)

Mr. B.H. Marlapalle, Sr. Adv.

Mr. M.K. Subramanian, Adv.

Mr. Kaustubh Shukla, AOR

For Respondent(s)

UPON hearing the counsel the Court made the following

O R D E R

Learned counsel for the petitioner submits that indisputably assessment for the relevant period has not been completed by the Department so far. In which case, invoking Section 132 of the Central Goods and Services Tax Act, 2017 does not arise. He further submits that, even if, the alleged liability of Rs. 19 crores as is assumed by the Department is accepted, it is open to the petitioner to file appeal after the assessment order is passed; and as per the statutory stipulation, such appeal could be filed upon deposit of only 10% of the disputed liability. In that event, the deposit amount may not exceed Rs. 2,00,00,000/- (Rupees Two Crores), which the petitioner is willing to deposit within one week from today without prejudice to his rights and contentions in the assessment proceedings and the appeal to be filed thereafter, if required.

Issue notice on condition that the petitioner shall deposit Rs. 2,00,00,000/- (Rupees Two Crores) to the credit of C.No. IV/16/27/201HPU on the file of the Commissioner of GST & Central

Excise, Salem, Tamil Nadu and produce receipt in that behalf in the Registry of this Court within ten days from today, failing which the special leave petition shall stand dismissed for nonprosecution without further reference to the Court.

Subject to the above, notice returnable within three weeks.

Dasti, in addition, is permitted.

For a period of one week, no coercive action be taken against the petitioner in connection with the alleged offence and the interim protection will continue upon production of receipt in the

Registry about the deposit made with the Department within one week from today, until the disposal of this Special Leave Petition.

List the matter on 12.09.2019.

Liberty to serve the Standing Counsel for the State of Madras

is granted.

(DEEPAK SINGH) (INDU KUMARI POKHRIYAL)

COURT MASTER (SH) ASSISTANT REGISTRAR